By Jeff Childers, Substack, 10/25/24

🔥🔥 The historic BRICS Summit ended yesterday. Among other platforms, Business Insider ran its story headlined, “Putin has spent years championing the idea of de-dollarization — but a new reality is setting in.”

It turns out they aren’t creating a new currency to compete with the dollar. It’s much more ambitious than that.

How historic was this week’s Summit? On Wednesday, Bloomberg ran a story headlined, “IMF Sees Growth Shift Toward BRICS and Away From G-7 in New Outlook.” The G-7 has long been the world’s biggest and most influential economic alliance, composed of the United States, Japan, Germany, France, the UK, Italy, and, for some reason I will never understand, that economic powerhouse, Canada.

The “Group of Seven” used to be the world’s biggest economies. (Plus Canada.) Not anymore. Bloomberg said that in just the last six months, BRICS has surged ahead of the stumbling G-7 group in IMF forecasts:

Surpassing the G-7 is happening even without whatever the BRICS are doing with their collective financial system. But once that comes online, the G-7 will become even less relevant, and the BRICS even farther ahead.

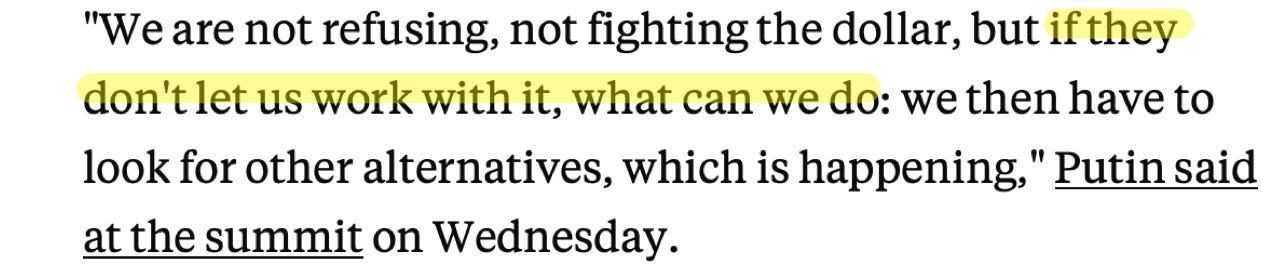

This woeful result proceeds directly from Joe Biden’s hysterical, anti-Russia sanctions. In Putin’s own words, quoted by Business Insider, BRICS isn’t anti-dollar, but all the sanctioning by the (smaller) G-7 countries is pushing the larger BRICS economic group to necessarily develop some kind of alternative:

Yesteday BRICS released a comprehensive plan to which its members and applicant members agreed. BRICS is not, in fact, creating any new global currency. Instead, it’s creating an alternative international payments platform, for people buying and selling things across borders, or for when nations trade with each other (to buy weapons, grain, or oil, for three examples).

Right now, everyone must use a common payment settlement system called SWIFT. SWIFT is U.S. created and effectively controlled, even though it is ostensibly privately owned and supposedly located in Belgium. The thought that SWIFT is at all independent is a great gag that everyone at the State Department always guffaws about making them cough champagne up their noses.

For many countries, SWIFT has at least two huge problems. When I say the platform is effectively U.S.-controlled, you can imagine all the implications. Users’ data is supposed to be private, but for some reason everybody thinks the U.S. constantly snoops on where all the money is going to and coming from. (One possibility for why they think that is because Edward Snowden exposed it all in 2013, but I digress again.)

The second, even bigger problem is that the U.S. acts like the spoiled kid at his birthday party, refusing to let the kids he doesn’t like ride the rented pony. In other words, the U.S. forces countries to do things they hate, like teach their kids trans techniques, by threatening to cut them off from SWIFT, or snatching their money as it travels through the collected SWIFT system.

Russia, for example, is cut off from SWIFT under U.S. sanctions. And $300 billion of its money was seized while sitting in a SWIFT clearinghouse bank. The implacable Russians are great poker players, you can never tell if they’re at all mad about Biden snatching their $300 billion or exploding their undersea pipelines.

But you can imagine how mad the Russians must be.

The Russians are mad enough to spend their time and money leading a world movement to replace the G-7 and its captive SWIFT system. Which would be horrible for us.

Once BRICS has its own interbanking system, they won’t need to trade in dollars anymore, not unless they need something from the U.S. or from a G-7 country. For complicated reasons, the reduced demand for dollars just from those lost transfers will drastically worsen our debt problem. And maybe more important for BRICS countries, the U.S. won’t be able threaten sanctions to force them to swallow every lunatic social experiment that comes down the liberal U.S. pike.

The BRICS pitched their interbanking system yesterday as a non-threatening “alternative” to SWIFT, rather than any kind of direct competitor. Having choices, they stressed, just improves everyone’s outcomes. But that logic is like claiming that when you parked your taco truck right next to Jose’s taco truck, it is actually better for Jose’s taco trade since diners like different choices of tacos.

Jose is not likely to agree. Jose is likely to go loco.

BRICS is not yet ready to switch the new platform on. But this week’s Summit was so significant that many articles, while not drawing a direct comparison, mentioned “Bretton Woods.”

Bretton Woods was the famous (or infamous) 1945 meeting where the winning countries after World War II created the international banking system, the IMF, and the World Bank. Yesterday, BRICS argued that things have changed since 1945. It’s like the G-7 is a seasoned citizen still using an iPhone 7. You can’t install any new apps. The international monetary system needs an upgrade.

The U.S. could shut this BRICS initiative down easily and immediately. All we need to do is reform SWIFT. If the U.S. stopped using SWIFT to sanction other countries, and SWIFT opened up its system transparently, and the U.S. stopped using SWIFT for spying, then BRICS would be unnecessary.

And everyone would keep trading in dollars.

In other words, we could rescue the dollar. We only need to give up the ‘dirty tricks’ tool we use to force other countries to make their kids sit through drag queen happy hours. But Biden’s neocons won’t try that simple remedy, will they? They’ll let the dollar be destroyed before they give up their economic wonder weapon.

3 thoughts on “IMF Sees Growth Shifting from G-7 to BRICS”

Comments are closed.