By Matt Stoller, Substack, 10/20/23

Welcome to BIG, a newsletter on the politics of monopoly power. If you’re already signed up, great! If you’d like to sign up and receive issues over email, you can do so here.

Today, as the U.S. is drawn into wars in Israel and Ukraine, as well as the defense of now-peaceful Taiwan, I’m writing about war. Not the policy choices, or whether U.S. military power is a net force for good or ill, but the actual practical machinery behind the American defense base that produces the weaponry necessary to sustain the military.

As stockpiles dwindle, there is now widespread agreement among policymakers that America must rebuild its capacity to arm itself and its allies. But according to a new scorching government report released this week, that’s mostly just talk. The Pentagon doesn’t bother tracking the guts of defense contracting, which is who owns the mighty firms that build weaponry…

…And now, let’s talk the defense base. Here’s an exceptionally boring chart that involves all the money in the world. Welcome to the Pentagon.

One of the more important side stories to the recent wars in Ukraine and Israel, and competition with China over Taiwan, is that the U.S. defense industrial base, composed of 200k plus corporations, is being forced to actually build weapons again. Defense is big business, and since the end of the Cold War, the government has allowed Wall Street to determine who owns, builds, and profits from defense spending.

The consequence, as with much of our economic machinery, are predictable. Higher prices, worse quality, lower output. Wall Street and private equity firms prioritize cash out first, and that means a once functioning and nimble industrial base now produces more grift than anything else. As Lucas Kunce and I wrote for the American Conservative in 2019, the U.S. simply can’t build or get the equipment it needs. There are at this point a bevy of interesting reports coming out of the Pentagon. The last one I wrote up earlier this year showed that unlike the mid-20th century defense-industrial base, today government cash goes increasingly to stock buybacks rather than actual armaments. And now, with a dramatic upsurge in need for everything from missiles to artillery shells to bullets, we’re starting to see cracks in the vaunted U.S. military.

The signs are unmistakable. In Ukraine, fighters are rationing shells. Taiwan can’t get weapons it ordered years ago. The Pentagon has put together a secret team to scour stockpiles to find high-precision armaments in demand on every battlefield and potential battlefield. But the problem goes beyond national defense. In Lake City, Missouri, the largest small arms ammunition plant in the world has decided all ammo production is going to the military, meaning that there is going to be a domestic shortage for hunters, sportsmen, and maybe even police. This shortage may look like a story of a sudden surge in demand, but it’s actually, as Elle Ekman wrote in the Prospect in 2021, a story of consolidation and de-industrialization.

Surges due to wars aren’t new, and there’s always some time lag between the build-up and the delivery. But today, the lengths of time are weirdly long. For instance, the Army is awarding contracts to RTX and Lockheed Martin to build new Stinger missiles, which makes sense. But the process will take.. five years. Why? What is new is Wall Street’s role in weaponry. We used to have slack, and productive capacity, but then came private equity and mergers. And now we don’t. The government can’t actually solicit bids from multiple players for most major weapons systems, because there’s just one or two possible bidders. So that means there’s little incentive for firms to expand output, even if there’s more spending. Why not just raise price?

But don’t take my word for it, take that of the Pentagon. In 2022, the DOD reported that “that consolidation of the industrial base reduces competition for DOD contracts and leads DOD to rely on a more limited number of suppliers. This lack of competition may in turn increase the risk of supply chain gaps, price increases, reduced innovation, and other adverse effects.” And that’s why, more than a year into the Ukraine conflict, the ramp-up is still not where it needs to be.

This week, the Government Accountability Office (GAO), which is a Congressional office charged with investigating problems in government and business, explained why. The GAO came out with a report on how the Pentagon is doing essentially zero oversight of Wall Street’s acquisitions of defense contractors. The title is as boring as you’d expect, designed to have few people pay attention, but offering a red-alert to procurement officials.

The report is simply jaw-dropping. Despite all the chatter about consolidation at high levels within the Pentagon, and in Congress, the bureaucracy has made essentially no progress whatsoever. For instance, we have a trillion dollar defense budget, but there are just two people in the Department of Defense who look at mergers in the defense base. You couldn’t staff the morning shift of a small coffee shop with that, and yet two people are supposed to look at the estimated four hundred mergers plus going on every year among defense contractors and subcontractors.

Four hundred mergers every year is a lot, but of course, that’s just an estimate. Why don’t we know how many acquisitions happen in the defense base? As it turns out, it’s an estimate because the Pentagon isn’t tracking defense mergers anymore. To put it in boring GAO-speak, Pentagon “officials could not say with certainty how many defense-related M&A now occur annually because they no longer track or maintain data on all M&A in the defense industrial base.” So the DOD is almost totally blind to the corporate owners of contractors and subcontractors, which might be one reason that, say, Chinese alloys are being discovered in sensitive weapons systems like the state of the art F-35.

BIG is a reader-supported newsletter focused on the politics of monopoly and finance. This is journalism and advocacy that challenges power, so please consider a paid subscription. You can always get lies for free. The truth costs a few bucks, but in the long run it’s much cheaper. You can subscribe by clicking here.

Upgrade to paid

It gets worse. There’s no policy or guidance on mergers, and DOD doesn’t even require contractors or subcontractors to tell them that there is new ownership when an acquisition occurs. In fact, the Pentagon relies on public news to learn of mergers. They often do not know that the mergers are going on, or that the Federal Trade Commission is reviewing them. When big mergers happen, even if the Pentagon is concerned, no one tracks what happens after it closes. They do no analysis of industry sectors, as their “M&A office is not collecting robust data or conducting recurring trend analyses that could help them identify M&A in risky areas of consolidation among defense suppliers.”

The Pentagon’s head-in-the-sand approach is why Lockheed now has a chokehold on nuclear missile modernization, since it bought the key supplier of rocket engines and denies those engines to rivals bidding for the contract to upgrade what is known as the nuclear triad.

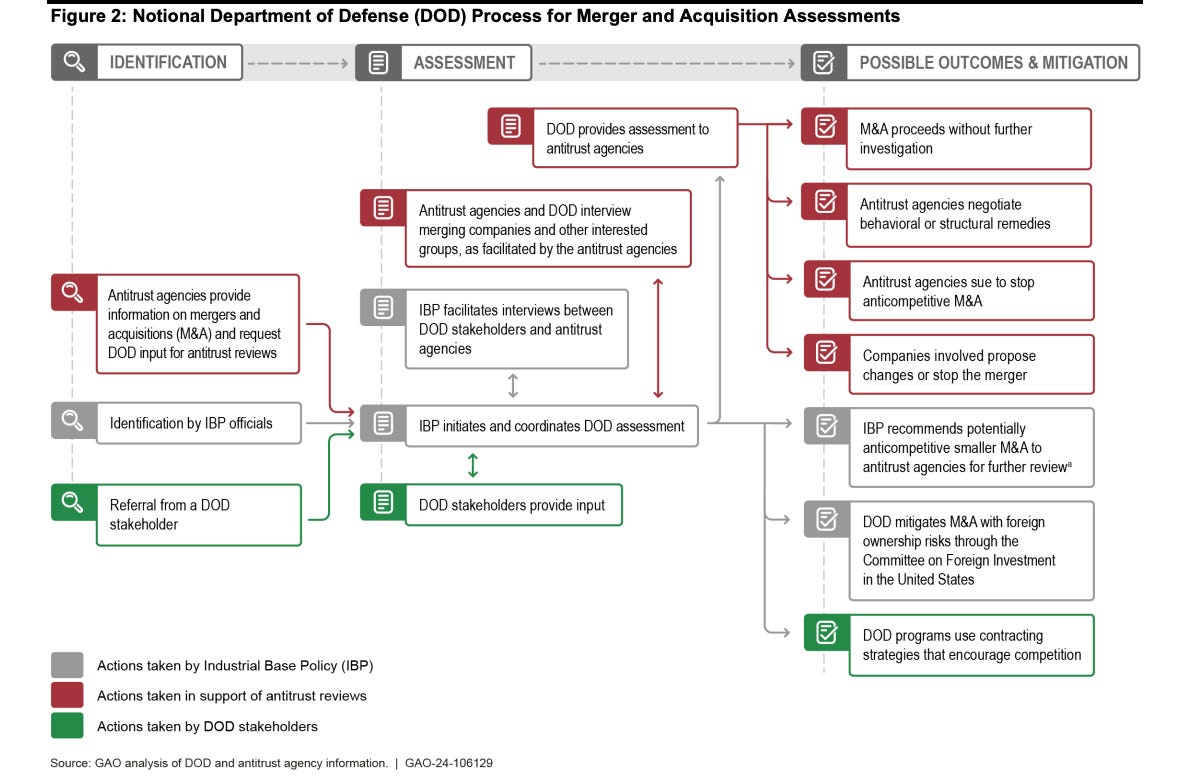

So how does the U.S. government manage defense base mergers? Well, the Pentagon defers to the antitrust agencies to look solely at competition. “While DOD policy directs Industrial Base Policy and DOD stakeholders to assess other types of risks, such as national security and innovation risks,” wrote the GAO, “they have not routinely done so.” Basically, dealing with their own defense base is someone else’s job.

What I found most useful about the GAO report is the Pentagon’s response, a classic bureaucratic hand wave. The DOD agreed with all the conclusions of the GAO. It should track mergers and what happens afterwards, it should have more personnel doing so, it should consider national security aspects of corporate combinations, and it should have clear policy on mergers. But it doesn’t. The DOD says it will have a better strategy to deal with mergers… by 2024. Basically, you’re right, but it’s not our problem.

Every day, it seems like political leaders and consultants are saying it’s time to really get that arsenal of democracy going, and to re-industrialize for real. It’s quite possible to get a lot done. The FTC and DOJ now have significant amounts of national security-related information on mergers due to a Congressional change in pre-merger notification laws in 2022, so the DOD could easily do a better job of tracking what’s happening in the defense base.

More to the point, the Pentagon is very powerful. The Deputy Secretary of Defense, Kathleen Hicks could simply start smashing heads on competition and begin telling contractors that if they don’t shape up, she will start an internal war against them. Or the head of the Armed Services Committees could threaten the cushy cash flow that leads to record stock buybacks among contractors, if the ramp-up doesn’t start. Or they could grant antitrust authority for the DOD straight-up, which would rely on a national security standard that allows widespread corporate restructuring without the long slog of a court case. There are many paths.

But if you actually look at the guts of the bureaucracy, nothing is happening, because doing something about our industrial base means thwarting Wall Street, and that’s generally not something that’s considered on the table among normie policymakers. Giant bureaucracies are hard to change, but they are not immovable. One of the ways that you know a previously non-functional bureaucracy is on the right track is, ironically, if there is bitter infighting and anger among staff, who are being tasked to do things differently. But as the GAO showed this week, that’s just not happening in the Pentagon, or at least, not happening nearly fast enough.

And that’s why America is increasingly out of ammunition.

America running out of ammo is a good thing. Too late to save the 500K dead Ukrainian soldiers, but maybe not too late to save 1 million innocent children in Gaza.